Condo Insurance

How will this quote help me?

Your condo insurance quote is based on several common factors to give you a clear picture of the cost you can expect for condo insurance, though an independent agent can shop around and maybe even improve your rate!

NOTE: This quote is not final, though we did work with professional actuaries to help get you a ballpark figure to get started.

Condo insurance is designed to cover the inside of your unit, including the walls and your personal property, against numerous threats, including fire damage, vandalism, and more. Condo insurance coverage can reimburse you for repairs or replacements to your personal property, like clothing, if it gets stolen, damaged, or destroyed. Some of your unit's built-in components, such as the flooring and cabinets, are protected by condo insurance against damage and destruction as well.

Getting the right condo insurance policy starts with obtaining a condo insurance quote, and an independent insurance agent can easily assist you. Having condo insurance can help protect you against having to pay for the costs of damage or destruction to your condo out of your own pocket. Here's a deeper breakdown of condo insurance and why it's necessary.

What Is Condo Insurance?

Condo insurance is essentially an agreement between the condo owner/renter and an insurance company, where the insurer agrees to cover financial losses for damage and liabilities in exchange for the premiums you pay. Condo insurance is designed to help protect owners from losing their homes should disaster strike, as long as they are within the boundaries of the covered perils laid out in their policy. Condo insurance protects your personal property and interior elements of your unit, as well as liability claims that may arise if there's an incident of personal property damage or bodily injury to a third party.

Is HO6 Insurance the Same As Condo Insurance?

HO6 insurance is another name for condo and co-op insurance. In comparison, homeowners insurance is often referred to as HO3 insurance, and renters insurance is referred to as HO4 insurance.

Condo insurance and HO6 insurance cover the interior of your unit or the part not covered by your landlord or condo association's master policy. From the walls to your personal belongings, this coverage can reimburse you for theft, damage, or destruction by listed disasters. It also covers your personal liability if you get sued by a third party.

What Does Condo Insurance Cover?

Beyond your personal spaces and any shared spaces you're responsible for, condo owners also need protection for friends, family, and other guests who may visit their homes, which means having legal or liability coverage. The more complex your condo and your individual responsibilities are, the more coverage you may need.

But here are the three major coverage areas included in standard condo insurance policies:

- Dwelling coverage: This covers your unit’s structural components, like the walls, ceilings, and floors.

- Personal property coverage: This covers your personal belongings like furniture, clothing, electronics, knickknacks, silverware, etc., that are stored within the unit against perils such as fire or theft.

- Liability coverage: This covers legal expenses, like attorney fees, court expenses, and settlements, if you get sued for bodily injury or property damage to a third party.

These three components make up the core of condo insurance packages. Working together with an independent insurance agent is a great way to get the right amount of coverage in each category for your unique home.

| Condo Coverage | Basic | Extra |

|---|---|---|

| Dwelling, walls in | ||

| Personal property actual cash value | ||

| Liability | ||

| Loss of use | ||

| Debris removal | ||

| Association loss assessment | ||

| Fire dept service charge | ||

| Medical payments to others | ||

| Ordinance or law | ||

| Sewer backup | ||

| Flood | ||

| Workers' compensation | ||

| Earthquake | ||

| Other structures | ||

| All perils | ||

| Scheduled personal property | ||

| Personal property replacement value |

What Doesn't Condo Insurance Cover?

Like every other kind of insurance out there, condo insurance comes with a list of specified covered perils as well as non-covered perils. Becoming familiar with what your condo insurance policy doesn’t cover can save you the hassle of filing claims that are bound to get denied and, in the event of certain non-covered natural disasters, help you find the right kind of policy to protect your home.

Condo insurance does not cover the following:

- Certain natural disasters (i.e., floods, earthquakes, and mudslides)

- Maintenance-related losses

- Wear-and-tear damage (i.e., failure of the condo owner to maintain upkeep of the home)

- Insect damage or infestations

- Damage from war or nuclear fallout

- Business-related liability

If you run a business out of your condo, your insurance won’t cover any liability-related mishaps. You'll need to look into a home-based business insurance policy or a special endorsement for that.

Further, to protect your unit against flood or earthquake damage, you’ll need a flood insurance or earthquake insurance policy. Condo owners located in areas prone to flooding may want to seriously consider getting a policy.

How Is Condo Insurance Different from Homeowners Insurance?

Condo insurance operates very similarly to homeowners insurance, but it’s customized to work specifically for the unique needs of condominiums. While the building itself is owned and insured by the condo association, your personal space needs insurance coverage in order to adequately protect you from the unexpected.

The term “condo” is a legal distinction for the type of property, and certain declarations are added to owners’ contracts to dictate what percentage of the “common elements” they’re responsible for (e.g., AC units, pools, etc.). As a condo owner, you're responsible not only for your own personal property but also for a few select elements of the main building and its common elements.

Since a condo owner has unique responsibilities that other homeowners don’t, the insurance policy is designed to cater more specifically to their needs. An independent insurance agent can walk through your condo's contract and clear up any remaining questions you may have.

How Much Is Condo Insurance?

Insurance companies determine the cost of condo insurance by reviewing a few factors, including your condo's location and its unique risks. Whether you have HOA coverage will also affect your premiums, as will the construction and value of your condo. The bigger and more expensive your condo is, the higher your condo insurance premiums are likely to be.

Many factors influence the cost of a condo insurance policy, including the size and location of your condo, the value of the structure and its contents, and any upgrades you’ve made. Condos located in areas prone to severe weather or other risks like crime will come with more expensive insurance policies than those in calmer, safer areas.

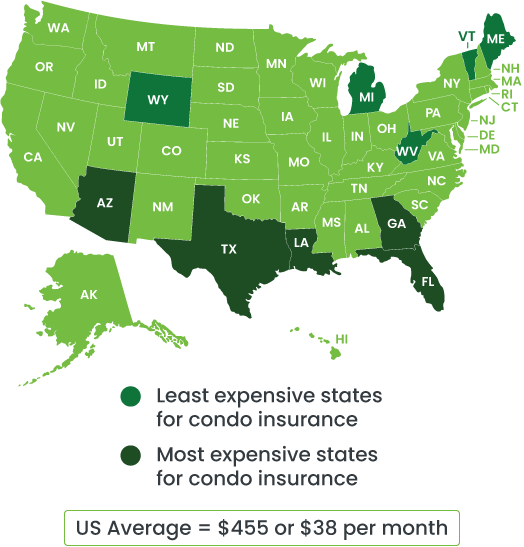

Currently, the average cost of condo insurance is about $455 per year for a policy with $50,000 of personal property coverage, $300,000 of liability coverage, and a $1,000 deductible. This translates to about $38 per month. An independent insurance agent can help find quotes for you.

Average condo insurance rates by state

| State | Average Annual Rate | Average Monthly Rate |

|---|---|---|

| Alabama | $555 | $46 |

| Alaska | $475 | $40 |

| Arizona | $775 | $65 |

| Arkansas | $585 | $49 |

| California | $710 | $59 |

| Colorado | $410 | $34 |

| Connecticut | $540 | $45 |

| Delaware | $405 | $34 |

| Florida | $1,130 | $94 |

| Georgia | $805 | $67 |

| Hawaii | $535 | $45 |

| Idaho | $355 | $30 |

| Illinois | $445 | $37 |

| Indiana | $455 | $38 |

| Iowa | $325 | $27 |

| Kansas | $425 | $35 |

| Kentucky | $360 | $30 |

| Louisiana | $845 | $70 |

| Maine | $305 | $25 |

| Maryland | $395 | $33 |

| Massachusetts | $520 | $43 |

| Michigan | $320 | $27 |

| Minnesota | $390 | $33 |

| Mississippi | $635 | $53 |

| Missouri | $445 | $37 |

| Montana | $390 | $33 |

| Nebraska | $395 | $33 |

| Nevada | $665 | $55 |

| New Hampshire | $360 | $30 |

| New Jersey | $445 | $37 |

| New Mexico | $400 | $33 |

| New York | $445 | $37 |

| North Carolina | $660 | $55 |

| North Dakota | $345 | $29 |

| Ohio | $330 | $28 |

| Oklahoma | $545 | $45 |

| Oregon | $450 | $38 |

| Pennsylvania | $330 | $28 |

| Rhode Island | $615 | $51 |

| South Carolina | $375 | $31 |

| South Dakota | $370 | $31 |

| Tennessee | $465 | $39 |

| Texas | $730 | $61 |

| Utah | $480 | $40 |

| Vermont | $255 | $21 |

| Virginia | $370 | $31 |

| Washington | $465 | $39 |

| Washington, D.C. | $420 | $35 |

| West Virginia | $255 | $21 |

| Wisconsin | $345 | $29 |

| Wyoming | $280 | $23 |

How Much Condo Insurance Do You Need?

Condo insurance provides coverage for more than just your belongings. It also protects you, your family, and your guests. To calculate how much coverage you need, you'll first consider your condo's specific protection requirements. The main coverages found in standard condo insurance policies are for the building's structure, your personal property, and your liability exposures.

Our quick quote calculator at the top of the page or an independent insurance agent can help you calculate how much condo insurance coverage you need. You'll need to go through each main coverage area and assess your needs in every category. You may need to increase coverage in one place, such as the contents section if you have a lot of personal property.

Condo Insurance Cost Factors

The cost of your coverage depends on a few factors, like your condo's location and value, your credit score (in states where allowed), and more.

Factors that determine the cost of condo insurance and how:

| Factor | Description | Impact on Condo Insurance Costs |

|---|---|---|

| Average annual premium | Across the US and DC | The national average cost for condo insurance is $488 annually, but rates vary by location and other factors. |

| Condo location | Including all 50 states and DC | Your condo's location impacts the cost of your coverage by factoring in your area's risk of crimes and storm damage and overall property values. |

| Condo value | The appraised value typically ranges from less than $50,000 up to $500,000 | Your condo's value impacts the cost of your coverage since more expensive units would cost more to repair/replace, so insurance rates are higher. |

| Age of building | The building's age, measured in years | Buildings more than 30 years old have much higher premiums due to the increased risk factor. |

| Deductible amount | Refers to the amount you have to pay out of pocket before the insurer covers a claim, ranging from less than $2,500 to more than $7,500 | Higher deductibles mean lower condo insurance premiums and vice-versa. |

| Type of HOA coverage | Homeowners Association Coverage varies from "bare walls" to "all in," etc. | The more comprehensive your HOA coverage, the smaller the condo insurance premium will be. |

| Security features | Installed security and safety features like burglar alarms, fire alarms, sprinklers systems, security arrangements with professional companies, etc. | More security/safety features can lead to lower premiums, and likewise, the absence of these features can increase premiums considerably or even lead to a rejection of a coverage application by the insurer. |

| Location exposures | If the property is located in a crime-prone or flood-prone area or is otherwise exposed to threats based on its location | Premiums for condo insurance can more than double if the building's location is considered hazardous. |

| Credit score | Your credit score, ranging from "poor" to "excellent" | Though not always a factor that impacts premiums, a "poor" credit score can lead to premiums up to double the usual amount. In contrast, "excellent" scores can reduce premiums by about 15%. |

| Insurance company | Condo insurance rates and premiums vary considerably by the insurer, as do the factors the insurer considers when determining premium rates | An insurance company awards additional discounts on condo insurance coverage if you have other coverages with them already. |

FAQs about Condo Insurance

We've got the answers to some of your most frequently asked questions about condo insurance.

Is condo insurance mandatory?

Condo insurance isn’t required by law, but nearly every lender will require a policy to give you a loan. At a minimum, they’ll want your policy to cover the amount you owe on the loan.

Your condo association has existing coverage to protect you, but that only covers your condo's exterior and shared spaces. When it comes to property and liability concerns inside your condo unit, you will need your own separate protection.

How is condo insurance different from homeowners insurance?

As you can imagine, because a condo is different from a home, the insurance coverages needed to protect each are different. With condos, you'll typically only need to insure the area within your own walls and not all the shared space, though this does vary. The condo insurance form reflects that limited coverage area. It doesn’t include things such as other structures that are located on your home’s property, such as a detached garage or utility shed.

What's the difference between condo insurance and an HO6?

An HO6 insurance form is the type of insurance that covers condos, so they are the same thing. Each type of property insurance that applies to individuals (and not businesses) has its own insurance form with different coverage sections and contractual language, such as HO1, HO2, HO3, HO4, HO5, and HO6.

What kind of coverage do I need for my condo?

Your condo insurance policy will come with some automatic coverage options, but you’ll need to work with your independent insurance agent to determine the appropriate values based on your specific needs. Typically, all condo insurance policies come with personal property and liability coverages, but you can always add on additional protections like water backup or personal cyber insurance.

What does my condo association's insurance cover?

The condo association’s insurance policy will typically cover the structure of the building, like the roof and walls. It typically covers any shared common areas as well, such as the lobby, pool, or exercise area. This will include both property coverage and liability coverage. It won’t, however, cover what’s located inside each condominium unit.

It's best to have your independent insurance agent review your condo association's policy to make sure you don't overlap coverages or leave any gaps.

Does my condo insurance cover damage to other units?

No, your own personal condo insurance policy will only apply to the property and space within the walls of your own condo. Other units will be covered under their owners’ insurance policies, while the condo association’s insurance policy will cover the common areas and base structure of the building. However, if you’re responsible for causing damage to another person’s condo unit, your liability coverage would be likely to pay for the other person’s damage.

Is condo insurance tax deductible?

No, condo insurance is treated the same as homeowners insurance by the IRS and isn’t tax deductible. There are other tax deductions that are similar, like mortgage insurance, but condo insurance is not a deductible item on your taxes.

How does my condo insurance protect me if I rent it as an Airbnb?

When it comes to renting your condo through Airbnb, or any other service, condo insurance protects you essentially the same way a homeowners insurance policy would while you’re away. If there was a fire at the Airbnb and your belongings got damaged or destroyed, you’d be covered under your personal property coverage the same way as you would under a homeowners insurance policy, even though you’re away from home.

Note that most insurers need to know about Airbnb rentals beforehand, as this kind of coverage is not always something they write. This coverage may also be excluded so be sure to speak to your insurance company or independent insurance agent before renting out your condo.

An Independent Insurance Agent Has Answers for All Your Condo Insurance Questions

With a brief intro into the terms, costs, and specifications of condo insurance, you now know the kinds of questions to ask. An independent insurance agent will ask you all about your condo, its use, and your future goals to help find the perfect blend of coverage at the right cost for your budget. They'll shop and compare policies from multiple insurance companies for you. And down the road, they can even file claims for you or help update your policy as necessary.