Get the Average Cost of Condo Insurance

The cost of condo insurance varies depending on your location and the coverage you need. However, average condo insurance costs fall between $200 and $2,000 annually, with $455 being the average, or about $38 monthly. An independent insurance agent factors in your location, how much coverage you need, your deductible amount and master policy deductible, and more when determining how much condo insurance is. Our figures are based on $50,000 of personal property coverage, $300,000 of liability coverage and a $1,000 deductible.

Condo insurance is also referred to as HO6 insurance, so the cost of HO6 insurance varies the same as condo insurance does. Having condo insurance is critical to protect against property damage, contents damage, and liability costs. We'll break down how condo insurance or HO6 insurance costs are determined in greater detail next.

Average Condo Insurance Cost by State

| State | Average Annual Rate | Average Monthly Rate |

|---|---|---|

| Alabama | $555 | $46 |

| Alaska | $475 | $40 |

| Arizona | $775 | $65 |

| Arkansas | $585 | $49 |

| California | $710 | $59 |

| Colorado | $410 | $34 |

| Connecticut | $540 | $45 |

| Delaware | $405 | $34 |

| Florida | $1,130 | $94 |

| Georgia | $805 | $67 |

| Hawaii | $535 | $45 |

| Idaho | $355 | $30 |

| Illinois | $445 | $37 |

| Indiana | $455 | $38 |

| Iowa | $325 | $27 |

| Kansas | $425 | $35 |

| Kentucky | $360 | $30 |

| Louisiana | $845 | $70 |

| Maine | $305 | $25 |

| Maryland | $395 | $33 |

| Massachusetts | $520 | $43 |

| Michigan | $320 | $27 |

| Minnesota | $390 | $33 |

| Mississippi | $635 | $53 |

| Missouri | $445 | $37 |

| Montana | $390 | $33 |

| Nebraska | $395 | $33 |

| Nevada | $665 | $55 |

| New Hampshire | $360 | $30 |

| New Jersey | $445 | $37 |

| New Mexico | $400 | $33 |

| New York | $445 | $37 |

| North Carolina | $660 | $55 |

| North Dakota | $345 | $29 |

| Ohio | $330 | $28 |

| Oklahoma | $545 | $45 |

| Oregon | $450 | $38 |

| Pennsylvania | $330 | $28 |

| Rhode Island | $615 | $51 |

| South Carolina | $375 | $31 |

| South Dakota | $370 | $31 |

| Tennessee | $465 | $39 |

| Texas | $730 | $61 |

| Utah | $480 | $40 |

| Vermont | $255 | $21 |

| Virginia | $370 | $31 |

| Washington | $465 | $39 |

| Washington, D.C. | $420 | $35 |

| West Virginia | $255 | $21 |

| Wisconsin | $345 | $29 |

| Wyoming | $280 | $23 |

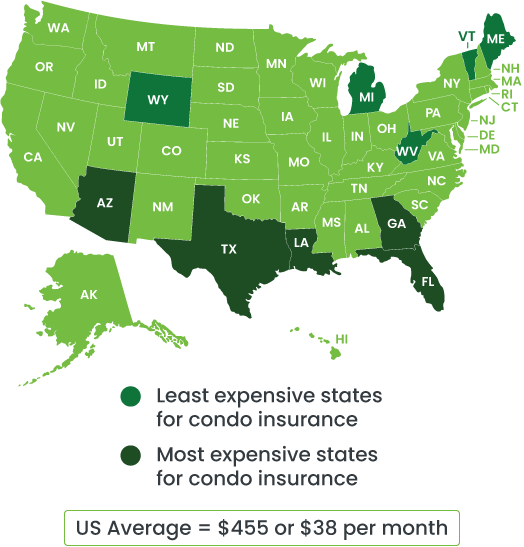

Most Expensive States for Condo Insurance

Condo insurance rates are higher in certain areas than they are in others. Condo insurance may be more expensive in certain states because of that area's risk of natural disasters like hurricanes or tornadoes or other disasters like crime. Property values may also be higher in those areas, increasing the potential cost to rebuild after a disaster.

The top 5 most expensive states for condo insurance are:

- Florida: $1,130 annually

- Louisiana: $845 annually

- Georgia: $805 annually

- Arizona: $775 annually

- Texas: $730 annually

Least Expensive States for Condo Insurance

Likewise, condo insurance rates are much cheaper in certain states than in others. Rates can be lower in certain areas due to a low risk of natural disasters or crime. Property values may also be lower in these states, creating less of a cost risk for repairs or rebuilding if necessary.

The top 5 cheapest states for condo insurance are:

- Vermont (tie): $255 annually

- West Virginia (tie): $255 annually

- Wyoming: $280 annually

- Maine: $305 annually

- Michigan: $320 annually

Average Cost of Condo Insurance by Coverage Limit

Your location certainly impacts your condo insurance costs, but the amount of coverage you need, or your coverage limit, is another major factor. We'll break down some average condo insurance costs by coverage limit, or the amount needed to insure a dwelling of a certain value, below.

| Condo value: | Average monthly rate: | Average annual rate: |

|---|---|---|

| Less than $150,000 | $14.11 | $169.33 |

| $150,000 to $200,000 | $19.54 | $234.46 |

| $200,000 to $250,000 | $23.09 | $277.09 |

| $300,000 to $350,000 | $31.75 | $381.00 |

| $350,000 to $400,000 | $39.69 | $476.25 |

| $400,000 to $500,000 | $43.66 | $523.88 |

| More than $500,000 | $47.63 | $571.50 |

Note: These values are based on condos in Colorado with a deductible amount of $5,001 to $7,500 and an applicant with a good credit score, using our condo insurance calculator.

Your Condo Association’s Policies Can Affect Your Coverage

- Condo association master insurance policies can have deductibles as high as $25,000.

- Some condo associations cover window maintenance and replacement, while others place that responsibility on the condo owner.

- Not all condo master plans provide coverage for damage caused by sewer or drainage backups.

- Some condo associations offer “all-in” master policies that include coverage for interior walls, floors and ceilings of units.

Understanding the Cost of Condo Insurance

Condo insurance rates can vary greatly depending on the value of the condominium, the geographic area, and the condo association policy. The primary factors that can affect the calculation of your condo insurance policy include:

- How much condo coverage you need to buy for complete protection

- The condominium coverage options you choose

- Your chosen deductible and whether you have master policy deductible coverage

- The location and construction of your condo

- Available deals and discounts

Are Condo Insurance and HO6 Insurance the Same?

Though condo insurance and HO6 insurance are often used interchangeably, there is a key difference. HO6 insurance is used for both condo insurance and co-op insurance and is a specific, customized type of homeowners insurance for both of these types of living situations. HO6 insurance protects the parts of your condo not covered by your condo association's master policy. The interior of your home, or everything inside the walls, along with your personal liability, is covered by an HO6 policy, similar to how condo insurance works. The association's master policy is responsible for covering anything outside the walls of your unit. An independent insurance agent can help you determine whether condo insurance or HO6 insurance is right for you.

How Much Should You Pay for Condo Insurance?

Independent insurance agents want to help you get a policy that meets all your coverage needs at the best possible price. These agents work for you, not for an insurance company.

Your local agent will ensure that you have a policy that provides the important coverage you need and will help you find ways to save on your premiums. Find a local independent insurance agent in your neighborhood today and get free condo insurance quotes and personal assistance.

How Much Is Condo Insurance On a Beach?

Similar to home insurance, one of the biggest factors that influences the cost of your condo insurance is your location. The average cost of condo insurance in the U.S. is $531 per year or around $44 per month. Average condo insurance rates can range anywhere from $276 to $1,049 per year, depending on which state you live in.

If you live on or near the beach, you can expect to pay near the higher end of the spectrum. Florida, for example, has the highest condo insurance rates in the nation, at $1,049 per year or around $87 a month, on average. Florida is a coastal state with wind, water, and severe weather hazards.

Wisconsin, an inland state, is the cheapest state for condo insurance. Condo policies in Wisconsin average $276 per year, or $23 per month.

How Much Is Condo Insurance In the City?

Just living in the city shouldn't affect the cost of your condo insurance too much, but if you live in a city with a higher crime rate than the national average, it might. The part of town you live in also affects your costs. Similar to homeowners insurance, the safer your home and its neighborhood are, the cheaper your coverage is likely to be.

Condos in the heart of a busy downtown area, particularly one that's not considered very safe, can pay a good deal more for their coverage. The current average cost of coverage for condo owners in New York City (NYC) is $691 annually. City rates also vary depending on your location in the city, the insurance company, the value of your condo, and your coverage limits. The highest average annual rate for condo insurance in New York is $1,464. The lowest: $217.

In contrast, condo insurance in Salt Lake City, UT, currently averages $358 per year, which is below the national average.

How Much Is Condo Insurance In the Suburbs?

The cost of condo insurance in a suburb depends heavily on the state in which the suburb is located. Just as property is cheaper in certain states, insurance coverage is also cheaper depending on the state.

Compared to condos inside the city limits of NYC, the average cost of condo insurance in Montclair, NJ, a suburb of NYC, is $438 annually. That's far less than the cost of condo coverage in the city, and even below the national average cost. An independent insurance agent can help you find exact condo insurance quotes for your area.

How Much Is Condo Insurance for a High-Rise Unit?

You might also be wondering if condo insurance is more expensive if your unit is in a high-rise building. While high-rise condos can face a bigger threat in case of a water leak, the building type specifically doesn't cause much of a price difference from another kind of condo, according to insurance expert Paul Martin. As long as your condo's building is well constructed, you can expect to pay close to the average rate for condo insurance.

How To Save Money On Condo Insurance

Condo insurance can be expensive, no matter where you live. Luckily, there are typically several discounts available from many insurance companies that sell condo insurance. Here are just a few of the most common.

- Safety features discount: Condo owners who install safety devices like alarm systems can earn a discount on their coverage.

- Sprinkler system discount: Condo owners who buy units equipped with sprinkler systems can earn a discount on coverage.

- Bundling discount: Customers who buy their condo insurance as well as another type of coverage, like car insurance, through the same carrier can get a discount on both coverages.

- Paid-in-full discount: Customers who pay for their entire year's premium up front can get a discount on their condo coverage.

- Claims-free discount: Customers who have not filed any claims within the past couple of years are likely to save money on their condo insurance as well.

An independent insurance agent can help you find any of these discounts that you may qualify for on condo insurance.

Sources

https://www.thebalance.com/condominium-and-coop-essential-insurance-guide-4068492

https://www.iii.org/article/insuring-co-op-or-condo

https://www.policygenius.com/homeowners-insurance/how-much-does-condo-insurance-cost/

https://www.valuepenguin.com/average-cost-of-condo-insurance

https://www.thehartford.com/aarp/condo-insurance/costs

https://www.nerdwallet.com/article/insurance/condo-insurance-cost

https://www.condoinsurancecoverage.com/condo-insurance-utah/

https://www.insurance.com/home-and-renters-insurance/condo-insurance-in-new-york-ny/