Mobile and manufactured homes are just as much at risk for property damage as traditional homes, if not more. In case a disaster happens, you want to be prepared and know how to file a claim so you can streamline the process of getting reimbursement. Filing mobile home insurance claims can be simple when you're aware of the steps to take.

A local independent insurance agent can also file mobile home insurance claims for you directly through your carrier. They can initiate the claims process and keep you updated every step of the way. But first, here's a guide to how to file mobile home insurance claims.

How to File a Mobile Home Insurance Claim: 8 Easy Steps

Whether you've experienced a disaster at your mobile home or you’re just trying to plan ahead, we'll outline the claims process for you to have on hand. If you need to file a mobile home insurance claim, you'll follow these simple steps:

Step 1: Assess and document the damage

The homeowner should start by taking photos and videos of the damage and writing down what’s been destroyed or stolen. If the damage is structural, use caution when moving through your mobile home.

If your mobile home is uninhabitable, your policy may reimburse you for additional living expenses while you must stay elsewhere. Just be sure to save any receipts during this time.

Step 2: File a police report if necessary

If you’ve been burglarized, contact local authorities right away. Provide them with all the details of the incident, including when and where the crime took place and what was damaged or stolen.

Step 3: Minimize further damage

If there's a hole in your home, cover it with plastic to prevent possible water damage. If any part of your property must be repaired immediately for safety reasons, keep all receipts for your insurance carrier.

Step 4: Contact your independent insurance agent

Now it's time to contact your independent insurance agent. Provide them with as many details about the situation as possible. Your agent can contact your insurance company directly to report the claim.

Step 5: Complete claims forms

Your agent or insurance company will then provide you with claims forms to complete. Include all the information you recorded from the incident and attach all necessary documentation, including any receipts for repairs or estimates you've already completed.

Step 6: Schedule a visit from an insurance adjuster

Your agent or mobile home insurance company will probably schedule a visit with a claims adjuster to come to your mobile home. They'll assess the extent of the damage and property loss. Sometimes, an insurance adjuster may provide you with a check for compensation during their initial visit, but not always.

Step 7: Track your claim

Your independent insurance agent will keep you updated through every step of the process and provide an ETA for every step of the process, including when you can expect a claims check to arrive. Alternatively, you can track the claim via your carrier's mobile app or website.

Step 8: Receive reimbursement

Finally, if your claim is approved, your insurer will either mail you a check or deposit the money directly into your online bank account. Remember that your deductible must be paid before you receive reimbursement. So, if your claim is approved for a $5,000 payout but you have a $1,000 deductible, you'd receive a possible maximum of $4,000 from your insurance company.

The process of filing a claim for mobile homeowners is similar to that for renters or other types of homeowners. If you need any further assistance with the claims process, contact an independent insurance agent.

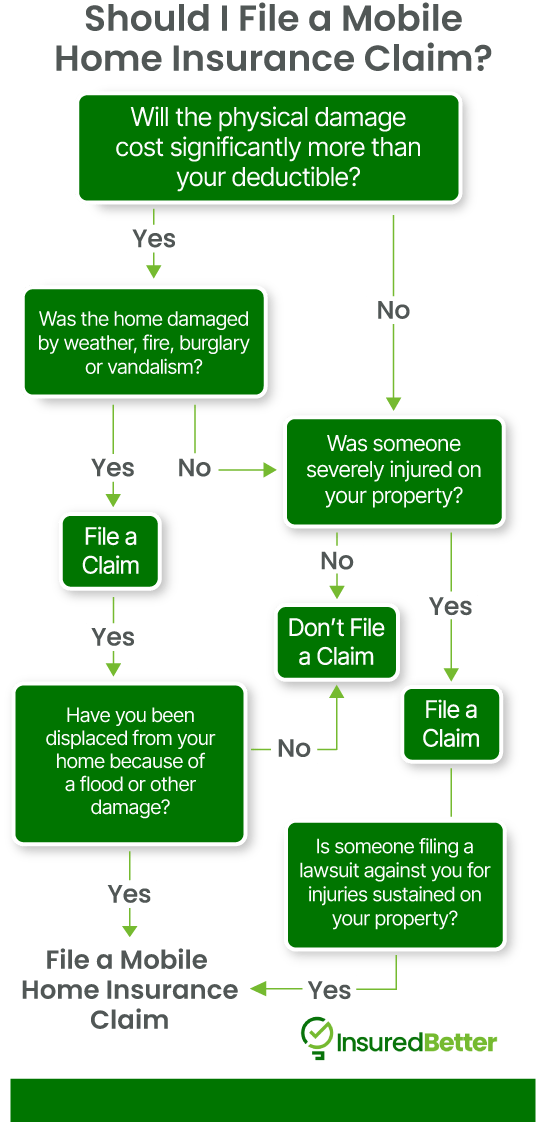

When to File a Mobile Home Insurance Claim

Mobile home insurance policies offer three kinds of coverage: physical damage to the dwelling, personal liability, and contents. Here are some common situations when you’d want to file a claim:

- If your mobile home has been damaged by natural disasters, fire, burglary, or vandalism

- If the physical damage to your mobile home will cost significantly more than your insurance deductible

- If someone is severely injured on your property and it will result in high medical bills

- If someone files a lawsuit against you for injuries sustained on your property

- If you’ve been displaced from your home due to a covered peril

If you're unsure of whether you should file a mobile home insurance claim, your independent insurance agent can help advise you. Keep in mind that your policy comes with exclusions, so damage or loss due to perils that aren't covered will likely be denied by your insurer.

How Do Mobile Home Claims Work?

Mobile home insurance claims follow a simple process. If you decide to file a mobile home insurance claim, the process progresses as follows:

- You’ll be assigned a claims adjuster: The insurance company will assign a specialist in mobile home damage to your claim.

- You and the adjuster will schedule an appointment: You’ll set up a time for them to come assess the damage.

- The adjuster will review your policy: After looking at the damage, the adjuster will review your policy to determine if the damage is covered.

- You’ll receive a verdict: A claims rep from your insurance company or the adjuster will contact you with the claim settlement and issue payment for losses. The reimbursement you receive is subject to your policy's coverage limits and deductible amount.

If your claim is approved, your insurer will issue you critical reimbursement for expenses related to damage or loss to your mobile home or its contents. Policyholders should understand what coverage is included in their policies to ensure they don't file a claim that's bound to be denied.

What You Can Do to Prepare for a Claim

When it comes to homeownership, your home is often your most valuable asset. So, whether it’s a mobile home, a modular home, or a traditional home, there are a few precautionary steps you can take to make the claims process a little smoother:

- Frequently check the foundation that your mobile home sits on and make sure it’s structurally stable.

- Make a video of your mobile home that shows your belongings. Narrate the video and state how long you’ve had items and where you bought them.

- Write down the replacement cost of items, not just the purchase price.

- Keep receipts from any furniture and home décor purchases.

- Know the specific model of your appliances and electronics.

- Keep records and receipts from any home upgrades.

- Have a list of all possessions and know how much they’re worth.

- Understand your insurance policy and what’s covered and not covered.

Information to collect for a mobile home insurance claim:

- Your name, address and contact details

- Your mobile home insurance policy number

- Date and description of the loss

- Extent of the damage and items lost

- Any injuries sustained

- A police report, if one exists

How Long Does a Mobile Home Insurance Claim Take?

Similar to homeowners insurance claims and other types of coverage, the amount of time it takes to complete the process can vary. Each insurance company handles claims slightly differently, and some may be more efficient than others. That's why it's helpful to choose a reputable insurance company that has a reputation for delivering on its coverage promises and honoring valid claims in a reasonable timeframe.

How to Negotiate a Mobile Home Insurance Claim

If you're unsatisfied with the ruling of your mobile home insurance claim, you may be able to negotiate it with your insurance company. Your independent insurance agent can help you with this. Whether you'll be able to successfully negotiate a different settlement will depend on your policy's limits and deductibles, and the cause of the loss reported.

Questions to Ask About Mobile Home Insurance

An easy way to make the claims process less daunting is by understanding your insurance policy. Mobile home insurance differs from traditional home policies in that there are two types of policies for mobile homes: actual cash value (ACV) and replacement cost coverage.

- ACV policies take into account the depreciation value of your home and belongings.

- Replacement cost policies are designed to provide the amount needed to repair damage in today’s market, minus your deductible.

In addition, you’ll want to be able to answer the following questions regarding your mobile home insurance:

- Do I have flood insurance?

- Do I have hurricane and windstorm coverage?

- How much coverage do I have in the event of a fire?

- Do I have sufficient contents insurance?

Your independent insurance agent can help you answer these questions and navigate the claims process with ease.

An Independent Insurance Agent Can Help You File Mobile Home Insurance Claims

If you need to file a mobile home insurance claim, a local independent insurance agent can help. Your agent can file claims directly through your insurance company for you and keep you updated through every step of the process. They can also help you shop around for cheaper coverage, find mobile home insurance discounts, or update your policy when necessary.