No matter how often you use your car, you want to make sure it’s protected as much as possible before you hit the road. You may have heard the term “full coverage” in association with car insurance before, and it can be tempting to ask for this option. However, “full coverage” really isn’t a standard industry term.

Fortunately, an independent insurance agent can help you get your vehicle fully protected regardless. They’ll work with you to find the best coverage for your needs and make sure you walk away with all the car insurance required to keep your ride safe. But first, here’s a closer look at what really constitutes full coverage.

What Is Full Coverage Car Insurance?

"Full coverage” car insurance is actually just a slang term used by the public, not officially by the insurance industry. Since asking for “full coverage” is essentially meaningless, it’s important to address what would actually constitute complete protection for your vehicle.

You'll want to consider liability protection against lawsuits, physical damage protection for your car, and coverage for injuries to others and possibly yourself and passengers in case of an accident. An independent insurance agent can help recommend the essential coverages you'll need.

Who Sells Full Coverage Car Insurance?

Car insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. Independent insurance agents know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could help you assemble a "full coverage" car insurance package, finding coverage could also depend on the area you live in. Here are a few of our top picks for full coverage car insurance.

| Top Full Coverage Insurance Companies | Overall Carrier Star Rating |

|---|---|

| Progressive |

|

| Nationwide |

|

| Liberty Mutual |

|

| USAA |

|

| Erie Insurance |

|

| Allstate |

|

- Best overall full coverage car insurance company: Nationwide

Nationwide is a leading insurer with an "A+" rating from AM Best. The carrier is on the Fortune 100 list and currently provides more than half a million customers across the U.S. with quality coverage. Aside from their outstanding insurance catalogue, Nationwide offers superior customer service and 24/7 claims reporting.

Nationwide is upfront about "full coverage" car insurance not being a standard product. Instead, the carrier works together with customers to assemble a comprehensive policy that considers every angle of desired protection. Nationwide offers the following car insurance policies to choose from:

- Bodily injury and property damage liability

- Personal injury protection

- Uninsured/underinsured motorist

- Medical payments coverage

- Collision coverage

- Comprehensive coverage

- Towing and labor coverage

- Rental car expense coverage

- Gap coverage

Nationwide also offers several perks for customers, including accident forgiveness and vanishing deductibles. With all their car coverage options, Nationwide is our top pick for full coverage insurance. An independent insurance agent can further help you decide if Nationwide is the right insurance company for your car insurance needs.

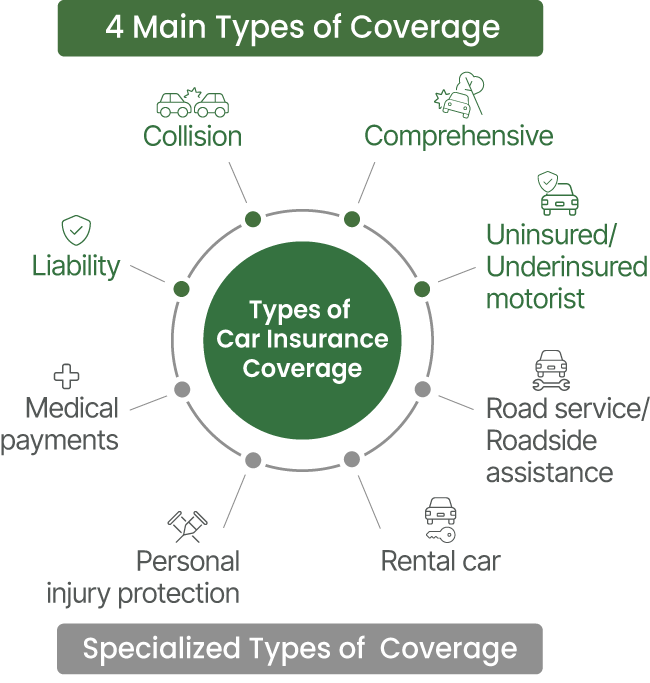

What Does Full Coverage Car Insurance Cover?

Most likely, if you’re asking for “full coverage” car insurance, what you’re really referring to is a package of a few of the most important and commonly purchased protections for your vehicle. A policy like this would probably include:

- Liability coverage: This is the legal minimum for coverage. The other types are recommended, but not required. It covers expenses related to bodily injury, personal property damage, and legal defense if you are sued.

- Collision coverage: Pays for damage to your car from a collision with another object, regardless of fault.

- Comprehensive coverage: Pays for damage to your car due to a non-collision event such as a flood or theft.

- Uninsured/underinsured motorist coverage: Covers medical or repair expenses that exceed the other driver's insurance. If the other driver is uninsured or carries only the cheapest coverage, you'll be protected. This coverage also protects you if you're involved in a hit-and-run accident.

Comprehensive insurance can cover damage to your vehicle from multiple perils, including hail. An independent insurance agent can help you determine which car insurance coverages are most important to meet your needs.

What Other Policies Are Included in Full Coverage Car Insurance?

You'll need to work with your independent insurance agent to assemble a coverage package that creates your ideal of "full coverage." But many policyholders choose to also add these policies to their full coverage car insurance:

- Medical payments coverage: Covers medical bills that go over what your liability insurance covers. If you don’t have health insurance, this is especially important.

- Personal injury protection: Covers medical expenses regardless of who's at fault in the accident. This coverage isn't offered in all states.

- Accident death benefit: A payment that is made if a person dies as a result of an auto accident.

- Rental car reimbursement coverage: Covers rental car costs while your car is being repaired after an accident.

- Roadside assistance coverage: Covers emergency tows, battery jump starts, and other roadside mishaps.

You'll know your "full coverage" package is complete when you feel you're set up with a full picture of protection. It's always worth it to review your existing coverage and decide if you'd feel comfortable adding more, as well. Keep in mind that your state may require various types of auto insurance beyond liability, so it's critical to ensure your policy includes all of these.

Liability-Only vs. Full Coverage

Liability-only insurance will protect you from damage or injuries you cause to other drivers or individuals with your vehicle. This type of policy does not cover damage to your own vehicle or many other aspects covered by a "full coverage" policy.

If you seek full coverage, you'll likely walk away with at least liability insurance, comprehensive insurance, and collision insurance for your vehicle.

| Liability-Only Coverage |

|---|

|

|

|

|

| Full Coverage |

|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

An independent insurance agent can further illustrate the many differences in having liability-only coverage vs. "full coverage" car insurance.

What Does Full Coverage Car Insurance Pay For?

Depending on the exact coverages you select for your policy, full coverage car insurance pays for numerous disasters. This often includes:

- Damage you cause to others and their property

- Damage to your own vehicle, even if you cause the accident

- Damage to your vehicle from a natural disaster

- Expenses from medical treatments to you and your passengers if you cause an accident

- Expenses from medical treatments to you and your passengers if you're hit by an uninsured/underinsured driver

- Damage to your own vehicle if you collide with a large animal, like a deer

- Costs of repairing a cracked or shattered windshield

Full coverage car insurance covers costs for all kinds of threats to drivers, their passengers, and their vehicles. If you're still unsure of whether full coverage is the best choice for you, an independent insurance agent can help you decide.

What Doesn't Full Coverage Car Insurance Pay For?

Though you might expect full coverage to cover absolutely everything, the truth is it doesn't. Even full coverage car insurance has exclusions, such as:

- Intentional acts

- Business use of a personal vehicle

- Ridesharing use of a personal vehicle

- Street racing accidents

- Off-roading accidents

- Government confiscation of a vehicle

An independent insurance agent can help review your car insurance policy with you to determine its exact exclusions.

Should I Add Optional Coverages?

Though it may be tempting to purchase only your state's legal minimum requirements for car insurance, it's important to consider adding additional policies to cover yourself, your vehicle, and others more completely. Without this extra coverage, you could end up paying thousands of dollars out of your own pocket in case of disaster.

However, if you have an older vehicle or one that's otherwise considered to have a very low value (typically less than $2,000), having full coverage might not make sense. Be prepared to cover the full cost of the vehicle in case of an extreme accident if you choose to only purchase the minimum coverage required.

What Are the Benefits of Getting Full Coverage Car Insurance?

"Full coverage" provides a complete package of protection, including liability, physical damage protection, and coverage for injuries to both the driver and passengers. The major benefit of choosing full coverage over a liability-only policy is financial protection against multiple possible scenarios. For example, a full coverage auto policy could reimburse you for damage to your vehicle after a collision with a deer and pay for your medical bills, while a liability-only auto policy wouldn't pay for either of these expenses.

While a liability-only or "minimum coverage" auto policy may satisfy your state's requirements for coverage and allow you to drive legally, it won't offer a lot of important reimbursement in case of disaster. Consider all the possible scenarios in which you may want more coverage than just the minimum.

Failing to purchase enough car insurance coverage could result in you having to pay tens of thousands of dollars out of pocket after just one accident. Not to mention, you may not be able to afford to replace your vehicle if it is totaled.

The Most Common Car Insurance Claims

- Collisions with other vehicles

- Whiplash

- Back injuries

- Windshield damage

- Theft

- Vandalism

- Collisions with animals

Having full coverage car insurance can help to cover many of the most common car insurance claims. For example, collisions with animals, windshield damage, and theft would only be covered if you had comprehensive insurance, which is often a big component of full coverage car insurance.

How Much Does Full Coverage Car Insurance Cost?

The cost of your full coverage car insurance package will depend on a number of factors, including your driving history, age, coverage limits, and location. However, there are average coverage rates by state to give you a better idea.

| State | Average Annual Cost of Full Coverage | Average Annual Cost of Minimum Coverage |

|---|---|---|

| Alabama | $2,076 | $500 |

| Alaska | $2,401 | $497 |

| Arizona | $2,754 | $817 |

| Arkansas | $2,490 | $502 |

| California | $3,066 | $760 |

| Colorado | $3,210 | $587 |

| Connecticut | $2,717 | $1,058 |

| Delaware | $2,786 | $958 |

| Florida | $4,143 | $1,121 |

| Georgia | $2,948 | $1,041 |

| Hawaii | $1,710 | $403 |

| Idaho | $1,470 | $369 |

| Illinois | $2,368 | $641 |

| Indiana | $1,757 | $408 |

| Iowa | $1,869 | $334 |

| Kansas | $2,547 | $575 |

| Kentucky | $2,813 | $755 |

| Louisiana | $4,009 | $1,032 |

| Maine | $1,641 | $425 |

| Maryland | $2,821 | $1,000 |

| Massachusetts | $2,089 | $535 |

| Michigan | $3,161 | $879 |

| Minnesota | $2,559 | $720 |

| Mississippi | $2,170 | $494 |

| Missouri | $2,576 | $655 |

| Montana | $2,404 | $402 |

| Nebraska | $2,373 | $510 |

| Nevada | $3,616 | $1,156 |

| New Hampshire | $1,836 | $492 |

| New Jersey | $2,864 | $1,156 |

| New Mexico | $2,207 | $436 |

| New York | $3,967 | $1,691 |

| North Carolina | $2,007 | $607 |

| North Dakota | $1,810 | $397 |

| Ohio | $1,600 | $431 |

| Oklahoma | $2,753 | $546 |

| Oregon | $2,035 | $852 |

| Pennsylvania | $2,436 | $517 |

| Rhode Island | $2,960 | $920 |

| South Carolina | $2,031 | $640 |

| South Dakota | $2,354 | $376 |

| Tennessee | $2,090 | $512 |

| Texas | $2,572 | $724 |

| Utah | $2,144 | $778 |

| Vermont | $1,497 | $313 |

| Virginia | $2,142 | $694 |

| Washington | $1,865 | $562 |

| West Virginia | $2,201 | $565 |

| Wisconsin | $1,935 | $446 |

| Wyoming | $1,759 | $263 |

| District of Columbia | $2,891 | $835 |

An Independent Insurance Agent Can Help You Find Full Coverage Car Insurance

When you're looking for full coverage car insurance, independent insurance agents are your best resource. They have access to multiple insurance companies, ultimately finding you the best full coverage car insurance, accessibility, and competitive pricing while working for you. And down the road, your agent can file car insurance claims for you directly and update your coverage as necessary.

Frequently Asked Questions About Full Coverage Car Insurance

Why is it called full coverage car insurance if it isn’t an actual policy?

Full coverage car insurance is not an actual policy by industry standards, but it is a helpful term for consumers. When customers ask an agent for full coverage, the agent knows that the customer is looking for a complete picture of protection for themselves, their passengers, and their vehicle.

From there, the agent can work to assemble the right package of coverage for the customer, including comprehensive and collision insurance, and more.

What does full coverage car insurance consist of?

Full coverage car insurance isn't a standard policy, so the coverages included can vary greatly. However, full coverage car insurance usually consists of at least:

- Collision coverage

- Comprehensive coverage

- Medical payments coverage

- Liability coverage

- Uninsured/underinsured motorists coverage

Your full coverage car insurance package may include even more types of coverage than this, or your coverages may differ.

Why do I need full coverage car insurance?

You need full coverage car insurance to fully protect yourself, your assets, and your passengers while on the road. If you purchase only the state minimum requirements of coverage, you may not be able to pay for repairs to your car, or for the medical treatment of your passengers or yourself in case of an accident.

What extra protection, if any, will full coverage car insurance give me?

Over the state's minimum insurance requirements, full coverage will grant you the following additional protection:

- Damage to your own vehicle, even if you cause the accident.

- Damage to your vehicle from a natural disaster.

- Expenses from medical treatments to you and your passengers if you cause an accident.

- Expenses from medical treatments to you and your passengers if you're hit by an uninsured/underinsured driver.

- Damage to your own vehicle if you collide with a large animal, like a deer.

- Costs of repairing a cracked or shattered windshield.

An independent insurance agent can further explain the additional coverage provided by full coverage policies.

Sources

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

https://www.bankrate.com/insurance/car/states/#average-car-insurance-cost-by-state