In recent years, more than six million non-fatal motor crashes have been reported annually in the U.S. But even most non-fatal crashes result in injury. Should you get injured in an accident without personal injury protection (PIP) coverage in your car insurance policy, you could have to pay expensive medical bills out of pocket.

An independent insurance agent can help you get set up with all the PIP coverage you need and any other types of car insurance you may want. They'll get you matched to the right policy fast. But first, here's a breakdown of personal injury protection and what it covers.

What Is Personal Injury Protection Insurance?

Personal injury protection, also known as PIP or even "no-fault insurance," is a type of car insurance coverage that can be added to your auto insurance policy. This coverage is mandatory in some states and offered as an optional add-on in others. PIP coverage helps pay for medical bills related to an accident, regardless of who's at fault. It also covers accidents that occur when you're not driving, such as riding your bike or riding as a passenger in someone else's vehicle.

What Does Personal Injury Protection or No-fault Insurance Cover?

Policies vary from state to state, but PIP or no-fault insurance typically covers accidents and injuries involving a moving vehicle of any kind. PIP helps cover medical bills due to a vehicle accident. It can also provide coverage for lost wages, funeral expenses, and replacement services.

PIP coverage or no-fault insurance can include the following:

- Medical bills: PIP covers any medical bills related to hospitalization, operations, and additional medical care after an accident.

- Lost wages: If you’re injured to the point of not being able to go back to work, PIP can provide up to six weeks of coverage for your lost wages.

- Funeral services: If someone dies in a vehicle accident, PIP can help pay for funeral costs.

- Replacement services: If your injury leaves you unable to continue everyday activities such as mowing the lawn, PIP can provide funds for you to hire someone else to help with these tasks until you're able to.

Ask your independent insurance agent to help ensure your car insurance policy includes PIP or no-fault insurance.

What's Not Covered by PIP or No-fault Insurance?

Personal injury protection or no-fault insurance doesn't cover any damage done to your vehicle, vehicle theft, or damage to someone else's property. It also doesn't cover any medical expenses unrelated to the accident or exceeding your policy limits.

How Does PIP Coverage or No-fault Insurance Work?

In states considered "no-fault" states, if a driver gets injured in an accident, their auto insurance policy pays for their medical expenses related to the crash regardless of who was at fault for the accident. PIP coverage allows drivers to receive benefits to pay for their injuries even if the other driver was at fault and lacked their own insurance or if they were struck by a hit-and-run driver. Anyone in the policyholder's vehicle is covered by PIP or no-fault insurance, including passengers.

Is Personal Injury Protection Insurance Mandatory?

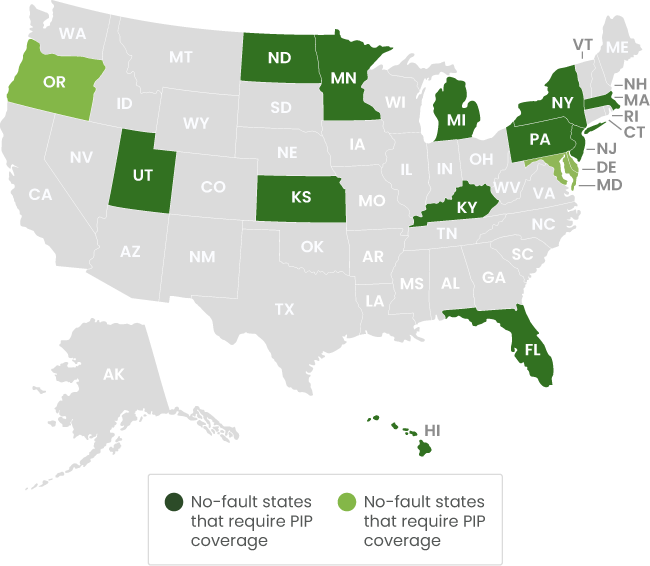

Currently, personal injury protection insurance is only mandatory in fifteen states and Puerto Rico. Twelve of these are no-fault states, meaning a driver is in charge of their own injuries and property damage in the event of an accident.

Typically, if you're in an accident with another person and it's not your fault, their insurance will pay for any damage or injuries. In no-fault states, everyone involved in an accident is required to file a claim with their own insurance, regardless of who is at fault.

No-fault states where PIP coverage is required

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Other states that require PIP coverage:

- Delaware

- Maryland

- Oregon

PIP is automatically included in your auto policy in these states unless you sign a refusal of coverage letter. In the remaining states, personal injury protection insurance can still be available, but it is not required.

Why Is Personal Injury Protection or No-fault Insurance Necessary?

In the event of an accident, PIP protects you, your family, and anyone in the car from out-of-pocket medical expenses. It even covers you when you’re riding in other people’s vehicles or if you’re riding on the back of a motorcycle. The coverage can prove to be very useful, especially if you have a high medical insurance deductible.

Even if you're not located in a no-fault state, PIP can protect you if you're in an accident with an uninsured or underinsured driver. If you spend a lot of time behind the wheel, it can provide an extra layer of protection against the risks you face on the road. However, keep in mind that PIP coverage isn't available in every state.

How Much Does Personal Injury Protection Insurance Cost?

The cost of PIP or no-fault insurance can range from $5 to $50 per month on average. The cost depends on your age, the make and model of your vehicle, and the amount of coverage you need. Working with an independent insurance agent can help you secure the most affordable coverage available.

Is Personal Injury Protection the Same as Liability Insurance?

No, these coverages are not the same. Liability insurance is a required type of car insurance coverage in most states. It's designed to help pay for medical expenses and property damage for someone else if you're at fault for an accident. Under a liability car insurance policy, you don't receive coverage for your own injuries.

Personal injury protection or no-fault insurance covers your injuries in the event of an accident. No matter who's at fault, if you come out with injuries and need to be hospitalized, your PIP policy can help reimburse you for related financial losses.

Do You Need Personal Injury Protection If You Have Health Insurance?

If you're injured in a car accident, your health insurance can help pay for the medical bills. However, PIP can help meet your health insurance deductible after an accident. In addition to providing medical coverage for you, PIP or no-fault insurance can also include coverage for lost wages and replacement services, which most health insurance plans don't cover.

The Benefits of Working with an Independent Insurance Agent

An independent insurance agent is your greatest ally for finding the right personal injury protection or no-fault insurance. They work with a number of car insurance companies to find not only the best coverage but the most competitive pricing. Down the road, your agent will also be there to help you file car insurance claims or update your coverage as necessary.

Sources

https://www.investopedia.com/terms/p/personal-injury-protection-pip.asp

https://www.allstate.com/resources/car-insurance/personal-injury-protection-coverage

https://www.forbes.com/advisor/car-insurance/pip-guide/