RV Insurance

How will this quote help me?

Your RV insurance quote is based on several common factors to give you a clear picture of the cost you can expect, though an independent agent can shop around and maybe even improve your rate!

NOTE: This quote is not final, though we did work with professional actuaries to help get you a ballpark figure to get started.

Recreational vehicles, or RVs, have been drawing lots of attention in recent years. No longer are RVs only used for occasional trips with the family, but many individuals have traded their traditional homes altogether for life on the road. As with any other investment, covering your RV with the right protection is critical. RV insurance can reimburse you for expenses related to collisions, lawsuits, theft, vandalism, weather damage, and much more.

A local independent insurance agent can help you find the right RV insurance. They'll get you matched to the ideal policy for your unique RV. But first, here's an overview of RV insurance, what it covers, and more.

Types of RVs and Motorhomes

Before determining what type of RV insurance you need, you must understand how your vehicle is classified. RVs are often broken down into the following categories:

- Class A motorhomes: These are the largest RVs on the road and are essentially homes on wheels.

- Class B motorhomes: These are smaller-sized RVs and more like nice-sized vans with amenities.

- Class C motorhomes: These are mid-sized RV models and are sometimes called mini motorhomes.

- Bus conversions: These refer to buses that have been converted into RVs.

- Travel trailers: These are towable motorhomes that are typically attached by a trailer hitch.

- Fifth wheels: These are towable motorhomes that are attached to a truck with a fifth-wheel hitch.

- Truck campers: These are add-on campers attached to a truck bed.

When you talk to your independent insurance agent about your RV coverage needs, you'll start here. Once you've discussed your plans and needs, you can move on to the RV insurance coverages you need.

Why Do You Need RV Insurance?

An RV is a unique combination of part home and part vehicle. RVs allow their owners to enjoy and combine comfort and luxury with mobility. Despite being on wheels, an RV includes homey comforts like beds, dishes, TVs, and refrigerators. As such, your RV needs an insurance policy tailored to protect all of its unique components and exposures.

But beyond that, a few recent stats may encourage you to get the right coverage for your RV:

- An estimated 8.9 million people in the U.S. own an RV.

- There are about 500,000 accidents every year due to trailer sway.

- About 75,000 hospitalizations each year result from RV collisions.

- About 10% of all RV drivers are seniors.

- About 26 people die every year due to RV collisions.

RV insurance is also often mandatory. If you've financed your RV, the lender most likely requires you to have RV insurance.

Additionally, most states require a liability policy at minimum to cover expenses related to third-party claims of bodily injury or personal property damage caused by you and your RV. Many states also require you to carry uninsured/underinsured motorist coverage in case you're hit by another driver who doesn’t have enough insurance to pay for their portion of the damages.

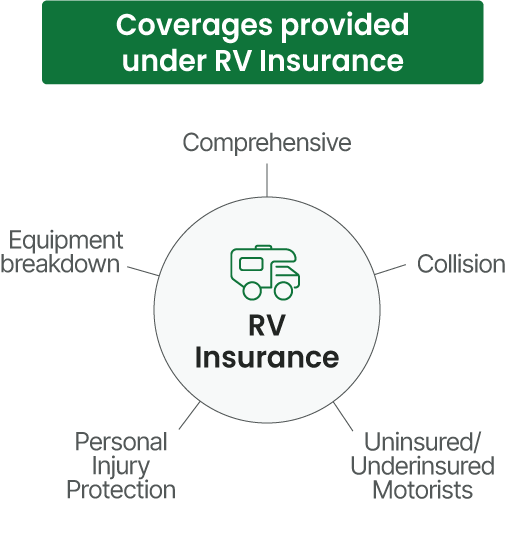

What Does RV Insurance Cover?

An RV insurance policy can cover several possible hazards. For convenience, some RV owners add coverage to their personal car insurance policies. However, choosing this option can leave you with coverage gaps. Further, some car insurers won't even allow you to insure an RV on their policies. As such, having a specific RV insurance policy is often recommended.

A major factor in determining the type of coverage you need is considering how you plan on using your RV. If you only use your RV for seasonal trips or as a permanent residence without moving it, you probably don't need as much protection as you would if you constantly travel on the road. Here are several of the most common RV insurance coverage options that are available:

- Liability insurance: Covers the costs associated with lawsuits arising from third-party injuries or property damage you're responsible for after an accident.

- Collision insurance: Pays for damage to your RV from a collision with another object, regardless of fault.

- Comprehensive insurance: Pays for damage to your RV due to a non-collision event such as a flood or theft.

- Personal injury protection insurance: This covers medical expenses, lost wage replacement, and various other expenses for you and your passengers if you get injured in an accident, regardless of fault. This coverage is not available in every state.

- Medical payments insurance: This covers the costs of medical treatments if you get injured in an accident, regardless of fault.

- Uninsured/underinsured motorists insurance: This can reimburse you for expenses after an accident with another driver who doesn't carry adequate insurance to reimburse you properly.

An independent insurance agent can help you build an RV insurance policy that includes all the necessary coverage.

Additional RV Insurance Coverage Options to Consider

You may want to add a few other types of protection to your RV insurance policy beyond the basics. These can include:

- Total loss replacement coverage: Pays to replace your RV in the event of a total loss.

- Physical damage coverage: Covers physical damage to or the theft of your RV.

- Pet injury coverage: Covers vet fees for an injury to an animal.

- Towing and roadside assistance coverage: Covers expenses related to professional towing and roadside assistance services if your RV breaks down or you get stranded on the road.

- Attached accessories coverage: This provides reimbursement for repairs or replacements of antennas and awnings.

- Personal effects coverage: Covers personal property like dishes and sporting equipment in your RV.

- Vacation liability coverage: Covers the cost of third-party bodily injury or property damage that occurs when the RV is used as a temporary residence.

Your independent insurance agent can recommend any additional types of RV insurance coverage that you may benefit from.

FAQs about RV Insurance

What is RV insurance?

RV insurance is similar to car insurance but designed to protect the unique components and exposures of recreational vehicles. You can customize your RV policy as you wish, but it should at least include liability coverage.

What does RV insurance cover?

RV insurance can cover many of the same risks your car insurance does, like collision, comprehensive, and liability coverage. However, since RVs are also used as mobile residences, you can get additional protection for your personal belongings, equipment, and attached accessories like awnings and satellite dishes.

How does RV insurance work?

Your RV insurance coverage can provide critical reimbursement after an accident or another covered disaster. RV insurance can potentially cover you in the following ways:

- If you have uninsured/underinsured motorists coverage and another driver hits you but is not insured, your insurance company can reimburse you for the other driver's portion of the damages.

- If you're at fault for an accident, the other driver will file a claim with your insurance company, which will pay the claim up to the limits of your liability coverage. You will pay the costs of any damages, injuries, legal fees, or judgments out of pocket beyond the limits set on your policy.

- If your RV is disabled after a crash and has to be towed, your insurance can cover some or all of the towing costs. However, you'd need to have added towing and roadside assistance coverage to your policy to get reimbursed.

- If your RV gets stolen or is damaged due to a hail storm, your comprehensive insurance can reimburse you for your loss up to your policy's limits after you've paid your deductible.

How much does RV insurance cost?

The average cost of RV insurance can vary based on many different factors. These can include the make and model of the RV you own, how often you plan to use it, your driving record, and your prior claims history.

Is RV insurance mandatory?

Liability coverage for an RV is required in most states. Certain states also require other types of coverage by law, such as uninsured/underinsured motorist coverage. Further, if you finance your RV, your lender likely requires you to have coverage.

How much RV insurance do I need?

The amount of RV insurance coverage you need depends on several factors, like:

- Your state's requirements

- Your RV's motorhome classification

- Your location

- How often the RV is used

- The motorhome's features and amenities

For help determining how much RV insurance you'll need, contact an independent insurance agent who can help you learn about the requirements in your state and the specific risks you may face.

Does my car insurance cover RV rentals?

Typically, yes, your existing car insurance can cover an RV rental. Depending on your policy, though, your car insurance may only cover driving-related accidents with the rented RV. In some instances, your whole personal auto policy may extend to an RV rental, including your liability, collision, and comprehensive coverage.

Where can I get the best RV insurance?

RV insurance is available from many carriers. However, working with an independent insurance agent can help you get the coverage you need, fast. Your agent can shop and compare RV insurance quotes from multiple insurance companies for you.

What RV insurance discounts are available?

There are many different RV insurance discounts available, but the options will vary by carrier. You might be able to earn a discount and save money on your policy by bundling your coverage, completing a safe driving course, or having an affiliation with a specific group.

Why work with an independent insurance agent when shopping for RV insurance?

With access to multiple insurance companies, independent insurance agents are unlike any other type of agent out there. They’ll help find you the best RV insurance coverage options and competitive rates in your area.

The Benefits of Working with an Independent Insurance Agent

Independent insurance agents can help you find the right RV insurance policy. They can shop and compare policies and quotes from multiple carriers for you. Ultimately, they'll get you matched to a policy that offers the best overall blend of coverage and cost. And down the road, your agent can help file RV insurance claims for you and update your coverage as necessary.